Buying a home is more than just a financial transaction; it is about planting roots. For families moving to the UAE, the prospect of buying your first home in Dubai can feel like standing at the base of a skyscraper impressive, but perhaps a little overwhelming. Between the legal jargon and the fast-paced market, it’s natural to feel a sense of anxiety.

However, Dubai’s real estate market has evolved into one of the most transparent and regulated environments in the world. Whether you are looking for a villa in a peaceful gated community or a modern apartment near Dubai Creek Harbour, this guide will walk you through the process with clarity and calm.

Can Expats Buy Their First Home in Dubai? (The Simple Answer)

The short answer is: Yes. Since 2002, the Dubai government has allowed non-GCC nationals to own property in designated Freehold areas.

Freehold vs. Leasehold: Plain English

Before diving into listings, you must understand the two types of ownership:

- Freehold zones: You own the property and the land it stands on indefinitely. This is the most popular choice for families seeking long-term capital appreciation.

- Leasehold zones: You own the right to the property for a fixed period (usually 99 years), but not the land itself.

For most expats, a Title Deed (Mulkiyya) in a freehold area like Dubai Hills Estate provides the highest level of security and a secure investment environment.

The Financial Roadmap for Buying Your First Home in Dubai: Mortgages and Costs

One of the biggest hurdles in buying your first home in Dubai is understanding the “true cost” beyond the sticker price.

Mortgages for Residents and Non-Residents

Dubai offers a robust mortgage market, but the Loan-to-Value (LTV) ratio varies:

- Residents: Typically, first-time expat buyers can get a mortgage for up to 80% of the property value.

- Non-Residents: Usually capped at 50% to 60%.

Before you start viewing homes, secure a mortgage pre-approval. This gives you a clear budget and shows sellers you are a serious “end-user” rather than a speculator. Keep an eye on EIBOR rates, as they will dictate your monthly repayments.

The Transparent Fee Structure

To avoid “sticker shock,” budget for these DLD-verified costs:

- DLD Transfer Fee: 4% of the purchase price (plus a small admin fee).

- Trustee Office Fees: Approx. AED 4,000 + VAT.

- Professional Valuation: AED 2,500 – AED 3,500.

- Agency Fee: Typically, 2% of the purchase price.

Step-by-Step: The Journey from Viewing to Keys

Navigating the step-by-step buyer journey is easier when you know what comes next.

Step 1: Choosing a Family-Oriented Neighborhood

Families have unique needs. Look for pedestrian-friendly walkways, proximity to nurseries, and school catchment areas. A family-oriented neighborhood isn’t just about the house; it’s about the community parks and play areas where your children will make friends.

Step 2: The Paperwork (Form B & Form F)

Once you find “the one,” you will sign Form B (Buyer-Agent Agreement) with your RERA-registered brokers. Next comes the MOU (Form F) this is the legally binding contract between you and the seller.

Step 3: The NOC (No Objection Certificate)

The seller applies for an NOC from the developer. This confirms the developer has no objection to the sale and all Service Charges (per sq. ft.) have been paid via the Mollak Portal.

Step 4: The Transfer (DLD)

The final step happens at a DLD Trustee office. You will hand over the payment, and in return, the Dubai Land Department (DLD) issues your new Title Deed (Mulkiyya). The process is remarkably seamless property transfer in action.

How Long Does the Process Actually Take? (A Realistic Timeline)

One of the most frequent questions we hear at Veer & Sant is: “When will we actually get the keys?” In Dubai, the step-by-step buyer journey is surprisingly efficient, but it does require coordination. For a secondary market property (ready-to-move-in), expect a timeline of 4 to 6 weeks.

| Stage | Action | Estimated Time |

| Phase 1 | Mortgage Pre-approval (Essential for a secure investment environment) | 3 – 7 Working Days |

| Phase 2 | Property Viewings & Negotiation | Variable (Typically 1–2 weeks) |

| Phase 3 | Signing the MOU (Form F) & Paying the Deposit | 1 Day |

| Phase 4 | Professional Valuation (Required by the bank) | 3 – 5 Working Days |

| Phase 5 | NOC Application (From the developer via Mollak Portal) | 5 – 10 Working Days |

| Phase 6 | Final Transfer at the Dubai Land Department (DLD) | 1 Day (The “Final Click”) |

Pro Tip for Families: If you are buying an off-plan project, the timeline shifts to years, but the Oqood (Pre-registration) happens within days of your initial down payment. For families needing to enroll children in schools, we recommend starting the search at least 3 months before the new term to allow for a seamless property transfer.

New Build (Off-Plan) vs. Ready Property

For families, this is a pivotal decision.

Off-Plan Projects

Buying off-plan projects often comes with attractive post-handover payment plans. However, it requires an Oqood (Pre-registration) and the patience to wait for completion. Always check the developer track record and ensure your payments go into a RERA-registered Escrow account protection scheme.

Ready-to-Move-in Homes

Most families prefer the secondary market trends for its “what you see is what you get” factor. It allows for a snagging inspection before you move in, ensuring there are no hidden maintenance issues.

Common Mistakes First-Time Buyers Make

- Ignoring the “Extra” Costs: Always factor in the 4% DLD fee. Use a rent-to-buy calculator to see if your monthly mortgage is truly cheaper than your current rent.

- Skipping the Snagging: Even for new homes, a professional inspection is vital to catch leaks or electrical issues.

- Falling for Speculation: Focus on lifestyle-driven investment rather than short-term flips. Aim for a high rental yield (ROI) as a safety net, even if you plan to live there.

Why Buy Now? Renting vs. Buying for Families

Is it better to rent or start buying your first home in Dubai?

- Renting: Offers flexibility but no equity. You are subject to annual rent hikes.

- Buying: Offers stability, 24-hour security in your own space, and a hedge against inflation. In a market transparency era, buying is often the smarter long-term move for those staying 3+ years.

Conclusion: Your Peaceful Transition to Homeownership

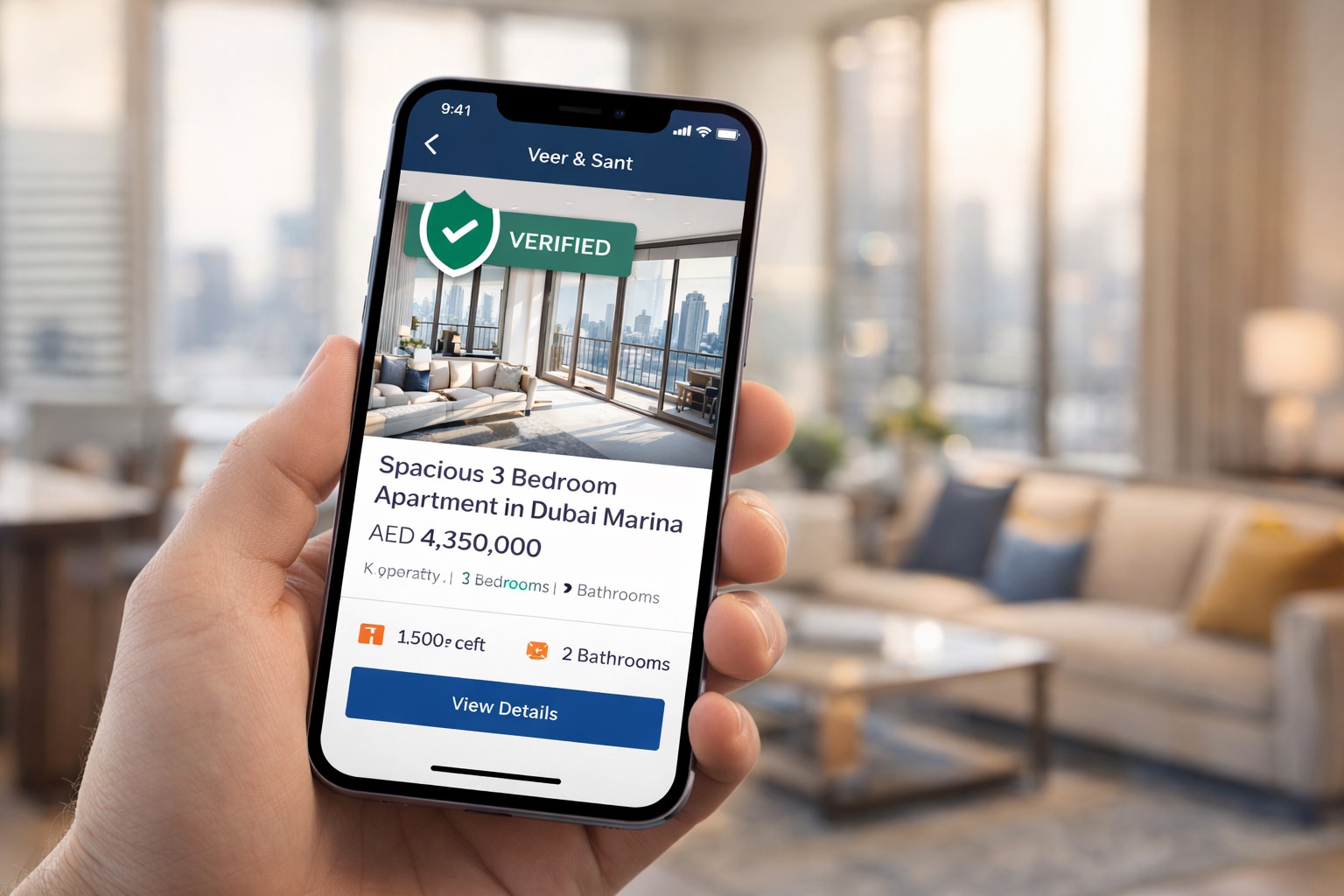

Dubai’s real estate market is no longer a “wild west.” With regulatory compliance and the Dubai REST App, the power is in the buyer’s hands. By focusing on sustainable living options and urban lifestyle amenities, you aren’t just buying a house; you are securing your family’s future in a secure investment environment.

Ready to find your family’s sanctuary?

At Veer & Sant, we specialize in DLD-verified listings and provide a transparent fee structure so you can focus on what matters most your family.