Golden Visas: Comparing the Numbers, Uncovering the Hidden Truth

For High-net-worth individuals and High-earner investors, the strategic pursuit of residency and a Second passport—often called Residency by Investment or Strategic investment migration—has become a top priority. Golden Visas in Greece, Portugal, and Dubai are the primary routes to achieving a sound Global mobility strategy and securing Dual citizenship eligibility.

However, while websites and agents compare initial entry fees, the hidden truth (The Truth Nobody Tells You) regarding long-term visa fees, taxation, and residency requirements is often ignored. The critical question remains: Is the EU passport worth the tax?

This article provides a deep, factual analysis of the real, long-term cost and benefit, demonstrating why, for most investors, Dubai’s long-term advantages often overshadow the initially perceived value of the Cheapest Golden Visa Europe.

1. Comparing the Numbers: Capital Outlay, Fees, and Initial Cost Analysis

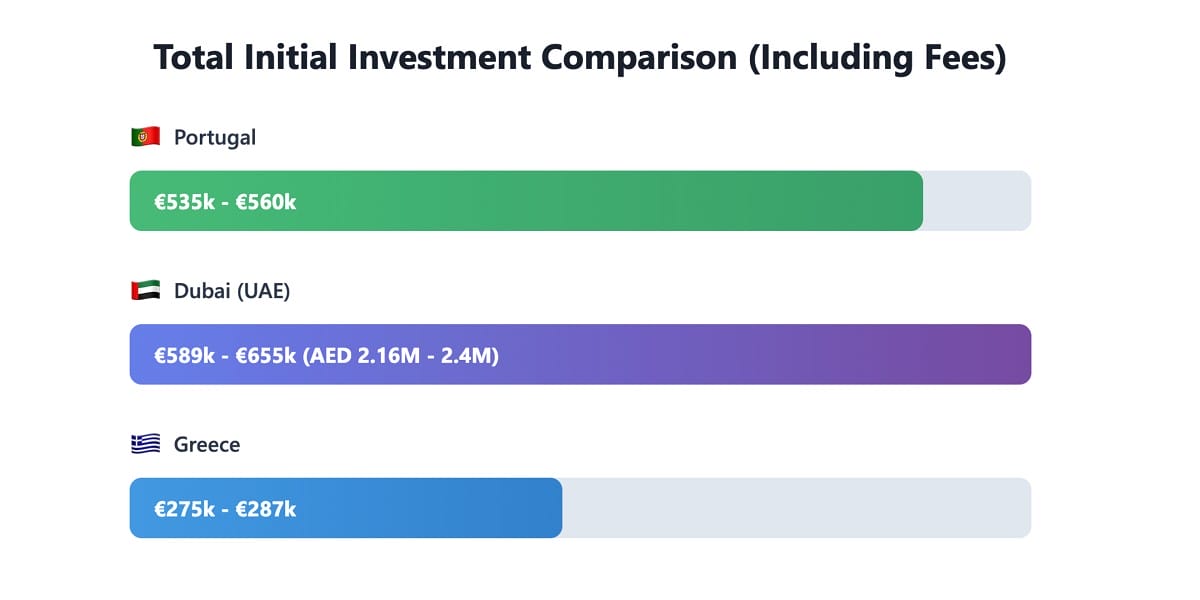

At first glance, comparing the Minimum investment threshold appears straightforward, but the true Initial cost analysis must include administrative fees, government charges, and property transfer taxes.

| Program | Minimum Investment (Capital Outlay) | Investment Type | Additional Fees & Taxes (Est.) |

| Dubai (UAE Golden Visa) | AED 2 Million property (Approx. €545k) | Real Estate Investment (Mortgage eligibility for foreigners allowed) | 8-10% (DLD fees, administrative costs, agency fees) |

| Greece (Greece Golden Visa) | €250k real estate Greece (or higher) | Real Estate Investment | 10-15% (Transfer tax, VAT, Legal/Notary fees) |

| Portugal (Portugal Golden Visa) | €500k fund investment (Real estate option removed) | Investment Fund Subscription | 5-7% (Subscription fees, legal fees) |

Truth No. 1: Greece Has the Cheapest Entry, But Requires Diligence

Greece, at €250k, offers the lowest nominal Initial cost analysis and provides immediate Schengen Area residency. However, investors must factor in high purchase closing costs (up to 15%) which significantly increase the total cash required. Portugal, with its focused requirement on €500k fund investment, demands a higher initial commitment but avoids real estate transaction complexities. Dubai, at approximately €545k (AED 2M), has the highest entry cost, yet its transaction costs are relatively transparent and lower than some European counterparts.

The smart investor knows that the true cost of a Golden Visa is not the entry price, but the hidden expenses over the subsequent five to seven years: Tax liability trigger and the Forced residency requirement (which leads to significant Annual living expenses). Analyzing the true Capital outlay over a seven-year period—factoring in opportunity cost, operating costs, and tax savings—radically changes the comparison.

2. The Hidden Truth: Why the UAE Golden Visa is Cheaper Long-Term for High-Net-Worth Investors

For high-income investors, the real cost of residency is not the property purchase, but the revenue you pay to the government. Here, Dubai is the undisputed winner:

A) The Tax Advantage: $100K+ Savings vs. 44% Tax

A core goal for many investors is to use their new Tax residency status to protect their global wealth. The difference between Zero personal income tax Dubai and the high tax regimes of Europe is a game-changer.

- Dubai (The Tax Champion): In Dubai, you benefit from Zero personal income tax Dubai. This is not a temporary benefit; it is foundational to the UAE’s economic structure. For an individual with a global annual income of $200,000, residing in Dubai translates to a direct saving of over $100,000 over 5 years compared to moving to a high-tax European country. This tax saving alone easily offsets Dubai’s higher initial investment, making it the superior financial decision for high-earners. Furthermore, Dubai has minimal Worldwide income taxation triggers, provided investors adhere to standard tax reporting protocols and maintain genuine economic ties.

- Europe (The Tax Risk): If you obtain a Portuguese or Greek Golden Visa and have significant global income, your path to EU citizenship comes with a major tax trap: the Tax liability trigger. To qualify for citizenship, you must effectively become a tax resident, which is tied to the 183 days per year rule. Should you do this, your Worldwide income taxation could be subject to heavy local taxes. Greece and Portugal can have income tax rates reaching up to 44%! This cost could be several times greater than your original investment, turning the EU passport into a significant liability.

B) Residency Flexibility: No Forced Residency Requirement, Lower Annual Living Expenses

- Dubai and Greece: Both programs offer you total flexibility. You are generally not subject to a substantial Forced residency requirement to maintain the Golden Visa status. This is crucial as it eliminates mandatory Annual living expenses in the new country, allowing investors to keep their primary life and financial base elsewhere. The only requirement is typically a visit once every few years.

- Portugal: While Portugal’s minimum stay is very low (7 days per year for the initial maintenance), the true trap lies in the long-term goal. The condition for naturalization process timeline still requires a significant increase in physical presence over the years, pushing the investor toward the 183 days per year rule and thus triggering tax residency. This effectively forces a lifestyle change and incurs real Annual living expenses.

C) Real Estate Rental Income and Financing (Real estate ROI)

- Profitability: Investing in property in Dubai provides not only residency but also superior profitability. The Dubai market typically offers very high Net Rental Yields: Approximately 7% net rental yield Dubai. Net yields in the Greek and Portuguese markets are generally between 4-5% European rental returns. This consistent 2-3% difference significantly boosts the investment’s Real estate ROI over a decade.

- Financing: Dubai also provides superior financial mechanics. Mortgage eligibility for foreigners is possible in Dubai for the Golden Visa property (with LTVs typically up to 60-70%), making the initial Capital outlay lower and increasing leverage. This ease of property financing is often more difficult or limited in European programs, where lenders are traditionally more cautious with non-resident borrowers.

3. The Reality of EU Citizenship: Weighing the Path to EU Passport Worth

The Path to EU citizenship is the main reason for choosing Europe. But here, the reality check hits hardest. Investors must precisely calculate the monetary value of Schengen Area residency and Dual citizenship eligibility against the irreversible cost of high taxation.

- Greece: 7-Year Citizenship and the Tax Trap: The Naturalization process timeline in Greece takes 7 years. The crucial point, however, is that to apply for citizenship, you must effectively become a tax resident and live in Greece for periods exceeding the 183 days per year rule for several years immediately preceding the application. This forced stay activates Tax residency status, compelling you to pay tax on your Worldwide income taxation. If you are a high-income investor, the question is: Is EU passport worth the tax when the cost is $200,000 or more in global income taxes? For most High-earner investors, the financial logic dictates that the cost outweighs the benefit.

- Portugal: The 5-Year Path and NHR: Portugal offers the fastest route to citizenship (only 5 years) and historically included the NHR Portugal (Non-Habitual Resident) scheme. The NHR scheme was a massive draw, providing tax exemptions or lower taxes on foreign income for up to 10 years. This benefit was excellent for those who genuinely intended to move. However, the Portuguese government has recently moved to abolish or severely restrict the NHR scheme, adding a critical layer of uncertainty and risk to the entire financial premise of the program. Investors whose sole goal is the passport without intending to move must remain very cautious, as the certainty of their future tax liability has been severely undermined.

The ultimate worth of an EU passport is mobility, but investors should ask: Is a Schengen Area residency permit (easily obtained via Greece/Dubai’s access to visas) not sufficient without accepting the financial risk of full EU tax residency?

4. The Smart Strategy: Dubai as Tax Base, Europe as Plan B

For the modern, tax-savvy investor, the optimal approach is to strategically leverage the best features of both regions. This Strategic investment migration works as follows:

Step 1: Establish a Tax Base in Dubai (Wealth Preservation):

- Goal: Obtain the UAE Golden Visa through an AED 2 Million property investment.

- Benefit: Establish legal residency in a zero-tax jurisdiction and protect global wealth due to Zero personal income tax Dubai. This is the financial anchor of the strategy.

- Action: Secure a property, obtain the 10-year visa, and immediately benefit from global asset protection.

Step 2: Add EU Access (Global Mobility):

- Goal: Obtain the Greece Golden Visa with a €250k real estate Greece investment.

- Benefit: Secure Schengen Area residency and EU access at the lowest cost, without being forced to become a tax resident (as you are not required to reside more than 183 days per year). The Greek program acts as an ideal Plan B and travel accelerator.

- Action: Execute the investment and use the Greek visa solely for hassle-free travel within the EU, maintaining tax residency in Dubai.

This hybrid strategy offers the best of both worlds: Dubai’s tax protection, high Real estate ROI, and wealth certainty combined with full Schengen access and Global mobility via the Greek Golden Visa. It strategically avoids the Tax liability trigger while maximizing both financial return and freedom of movement.

Conclusion

If your goal is EU citizenship at any cost, Portugal (5-year path) is the optimal choice, provided you accept the significant new tax uncertainties and the eventual activation of high tax rates. However, if your goal is wealth preservation, mitigating Tax liability trigger, and high investment returns, the Dubai Golden Visa is not just the better choice—it is, in the long run, the most cost-effective and intelligent path for High-net-worth individuals.