For most global investors, the UAE Golden Visa is viewed primarily as a residency permit—a ticket to live in Dubai. But for the savvy high-net-worth individual, it is something far more powerful: it is a proven path to high Golden Visa Investment ROI.

As we look toward the Dubai real estate market outlook (2025-2030), the narrative is shifting. It’s no longer just about buying a holiday home; it’s about securing financial freedom through Dubai investment. With a strategic AED 2M purchase, you aren’t just buying square footage; you are buying into a tax-efficient ecosystem that can double your capital in five years.

In this detailed analysis, we are going to move beyond the marketing fluff. We will show the math. We will calculate exactly how an AED 2M property transforms into AED 3.36M, compare Dubai vs. global property tax implications, and stress-test the investment against a worst-case market scenario.

The Base Calculation: How AED 2M Becomes AED 3.36M

Let’s start with the baseline. You purchase a prime property meeting the Golden Visa property requirements for AED 2,000,000 (approx. $545,000) in 2025.

Here is the 5-year investment forecast based on conservative capital growth projections and standard market rental yields.

The 5-Year Breakdown (2025-2030)

- Initial Investment: AED 2,000,000.

- Capital Appreciation: The Dubai market is maturing. Conservatively estimating a 5-6% annual compounding growth, the asset value appreciates by approx 30-35% over 5 years.

- Value Gain: + AED 700,000.

- Rental Income: Using a standard long-term rental yield calculator Dubai (averaging 6.5% net yield), reinvested or accumulated.

- Income Gain: + AED 660,000 (approx. AED 132k/year).

The Total Golden Visa Investment ROI

- Total Exit Value (Asset + Income): AED 3,360,000

- Net Profit: AED 1,360,000

- Total Return on Investment: 68%

This 68% return is the floor, not the ceiling. Depending on how you structure the deal, your returns can

be significantly higher.

4 Investment Scenarios: Maximizing Your Returns

Not all Dubai property investments are created equal. Below, we break down four distinct strategies to see how they impact your bottom line over the 10-year residency period.

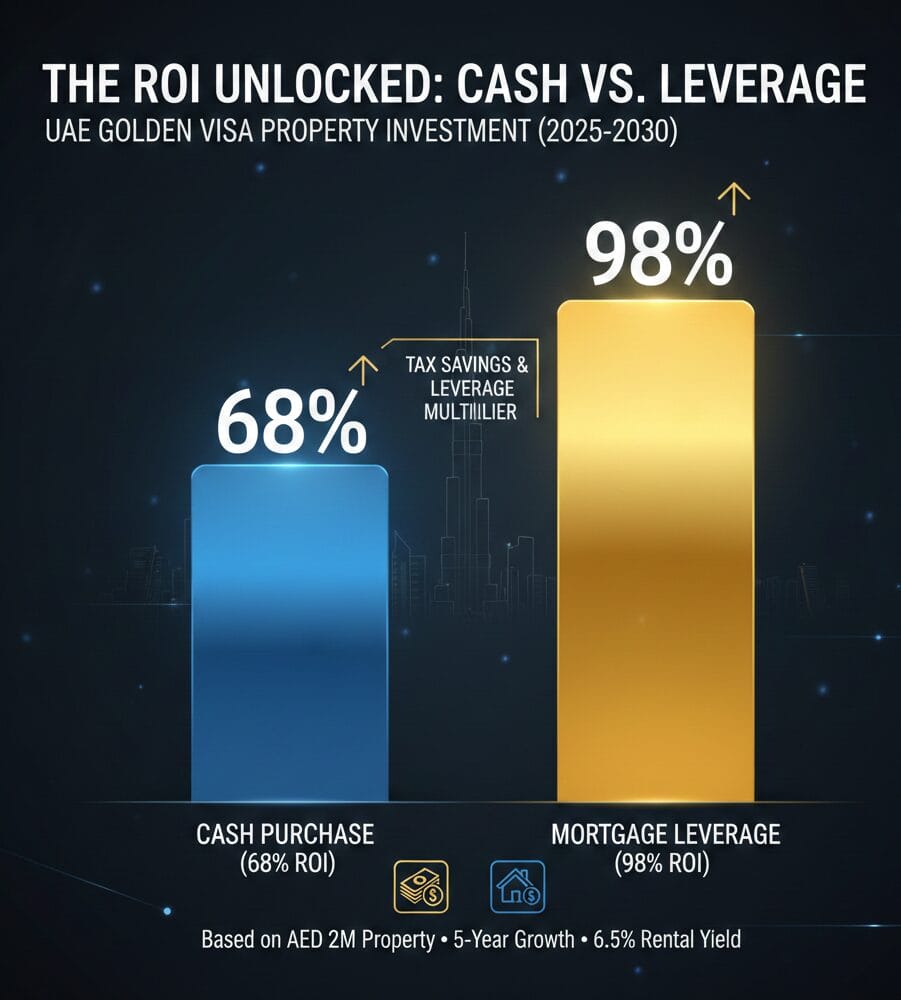

Scenario 1: The Cash Purchase (The Safety Play)

- Strategy: You buy the property outright with cash.

- Risk Profile: Low.

- Outcome: You secure the 10-year residency visa immediately and enjoy zero debt.

- ROI: 68%

- Verdict: Ideal for risk-averse investors prioritizing stability and steady cash flow.

Scenario 2: The 50% Mortgage (The Leverage Multiplier)

This is where investment leverage benefits kick in. Banks in the UAE are increasingly willing to lend to non-residents.

- Strategy: You put down AED 1M (50%) and borrow AED 1M.

- The Math: The property still appreciates on the full AED 2M value (AED 700k gain), but you only invested AED 1M of your own capital. Even after deducting interest costs (approx. 4.5%), your equity returns skyrockets.

- Golden Visa Investment ROI: 98%

- Verdict: Leverage nearly doubles your returns. This is the smartest route for expat financial planning.

Scenario 3: Short-Term Rental (The Yield Booster)

- Strategy: Instead of a yearly tenant, you utilize a short-term rental income strategy (Airbnb/Holiday Homes).

- The Math: Short-term rentals in prime areas often command 20-30% higher premiums than long-term leases.

- ROI: 83%

- Verdict: Requires active management (or a property manager), but significantly boosts annual cash flow.

Scenario 4: Buy Undervalued + Renovate (The Value-Add)

- Strategy: The value-add property strategy. You buy an older unit in a prime location (like the Shoreline on the Palm or older Marina towers) for AED 1.8M, spend AED 200k on renovation, and force appreciation.

- The Math: Renovated units sell for premium prices and command higher rents. You create instant equity the moment the renovation is done.

- ROI: 75% (Plus potential for higher capital gains upon resale).

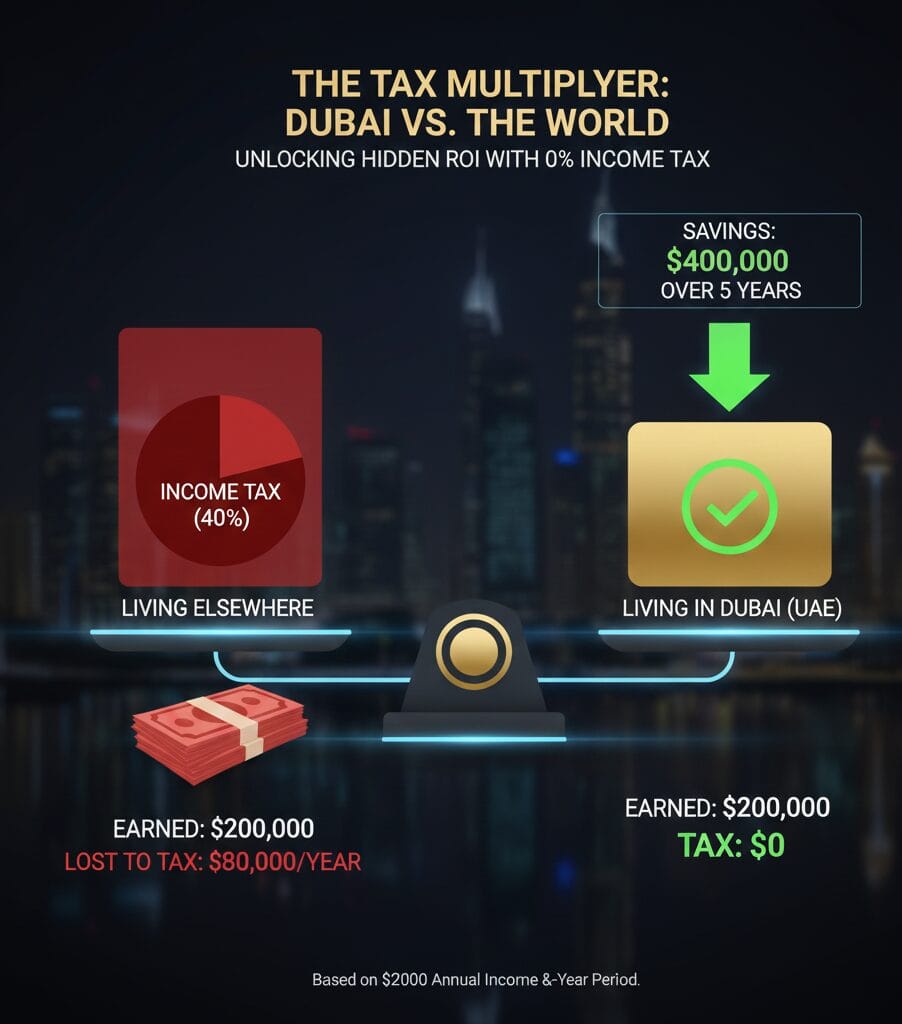

The Tax Multiplier: The Hidden ROI Accelerator

Most investors stop calculating at the rental yield. This is a mistake. The true power of the UAE Golden Visa benefits lies in the Tax Savings Multiplier.

If you move your tax residency to Dubai, your ROI isn’t just what you make; it’s what you save.

The $200K Example

Let’s assume you are a high-earner (freelancer, consultant, or business owner) making $200,000 (AED 734,000) per year.

- Living in the UK/Europe/Canada: You likely pay ~40% in income tax.

- Tax Cost: $80,000/year lost.

- Living in Dubai: You operate in a zero income tax environment.

- Tax Cost: $0.

- Savings: $40,000 – $80,000 per year (depending on your home country’s tax treaty).

The 5-Year Impact

Over the 5-year forecast of your property investment, you save $200,000 to $400,000 in taxes purely by holding a tax residency application via your property.

Revised ROI: When you add this tax savings to your property returns, your real ROI effectively doubles. The property pays for itself simply by shielding your active income.

Global Comparison: Dubai vs. The World

How does a Dubai property investment stack up against other major asset classes? Let’s look at the numbers.

| Investment Asset | Gross Return (5 Years) | Taxes & Fees | Net Return |

| Dubai Property | 68% | 0% Tax | 68% (Winner) |

| S&P 500(Stocks) | 36% (avg 7%/yr) | ~20% Cap Gains Tax | 28.8% |

| UK Property (London) | 10% (Low growth) | 45% Rental Tax | ~5.5% |

The Conclusion:

While the S&P 500 offers liquidity, it comes with tax drag. UK property suffers from low yields and high taxation. Dubai offers the unique combination of high growth, high yields, and zero tax.

Area Recommendations: Where to Invest AED 2M?

To achieve the ROIs mentioned above, location is critical. Based on Bayut and Dubai Land Department data for 2025, here are the top picks:

1. Business Bay: The High-Yield Engine

- Why: Central business district, high demand from professionals.

- Stats: Business Bay property returns are currently leading the market with 8% gross yields.

- Best For: Investors seeking maximum rental income.

2. Dubai Hills Estate: The Capital Growth Play

- Why: The “green heart” of Dubai. A master-planned community with high demand for families.

- Stats: 7% yield + consistently high appreciation due to community lifestyle.

- Best For: Dubai Hills family community living and long-term stability.

3. Dubai Marina: The Liquid Asset

- Why: The world’s most famous waterfront community. Always in demand.

- Stats: 6.5% yield.

- Best For: Dubai Marina liquidity. It is the easiest area to sell quickly if you need to exit.

The Worst-Case Scenario: Are You Safe?

Smart investors always ask: “What if the market crashes?”

Let’s stress-test the model with a worst-case market scenario where property values drop by 10% over the next 5 years.

- Asset Loss: – AED 200,000.

- Rental Income (5 Years): + AED 660,000 (Rents rarely drop as fast as asset prices).

- Net Result: You are still up by AED 460,000.

Even in a market correction, the high rental yields act as a buffer, keeping you profitable. When you factor in the tax savings multiplier (saving $40k/year in taxes), you remain significantly profitable even if the property value stays flat or dips.

Conclusion: Your Path to Residency and Wealth

The data is clear. Acquiring an AED 2M property is not just about obtaining a 10-year residency visa; it is a calculated financial move that outperforms global benchmarks.

Whether you choose the leverage of a mortgage (98% ROI) or the safety of a cash purchase (68% ROI), the combination of capital appreciation, rental yields, and tax efficiency makes Dubai the top destination for maximizing Golden Visa Investment ROI in 2025-2030.

Ready to run the numbers for your specific situation?

[Book Your Free Investment Consultation & Golden Visa Eligibility Check]