Deciding on Rent vs Buy in Dubai in 2026 is the most significant financial crossroad for residents in the UAE. As we look toward the Dubai real estate forecast for the next 5 years, the city continues to mature into a global hub of stability and luxury. However, with the rising rental index and shifting housing supply vs demand dynamics, the math behind this decision has become more complex.

This guide provides a deep-dive monthly outlay comparison and a 5-year financial projection to answer the ultimate question: Is 2026 a good time to buy property in Dubai?

1. The Rental Landscape: Will Rents in Dubai Go Down in 2026?

The primary driver for the current shift toward buying is the aggressive rental hikes witnessed across major communities. While many ask, Should I renew my contract or buy? the data suggests that renting is becoming an increasingly expensive “temporary” solution.

Explosive Rental Growth in Key Hubs

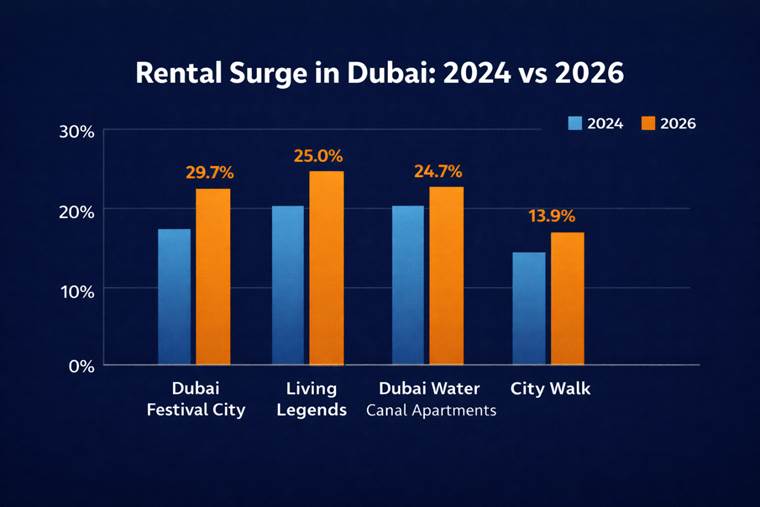

According to recent market data, the rental price for apartments in Dubai Festival City surged by 29.66% between 2024 and 2025. Other areas showing significant increases include:

- Dubai Water Canal Apartments: Up 24.73%.

- Living Legends: Up 24.96%.

- City Walk: Up 13.90%.

These figures highlight the inflation impact on rent, where tenants find themselves paying significantly more each year without gaining any equity accumulation. For many, moving costs as dead money combined with constant eviction fears and stressful lease renewal negotiations have made the lack of stability in renting a deal-breaker.

2. Rent vs Buy in Dubai: Mortgage Installment vs. Monthly Rent

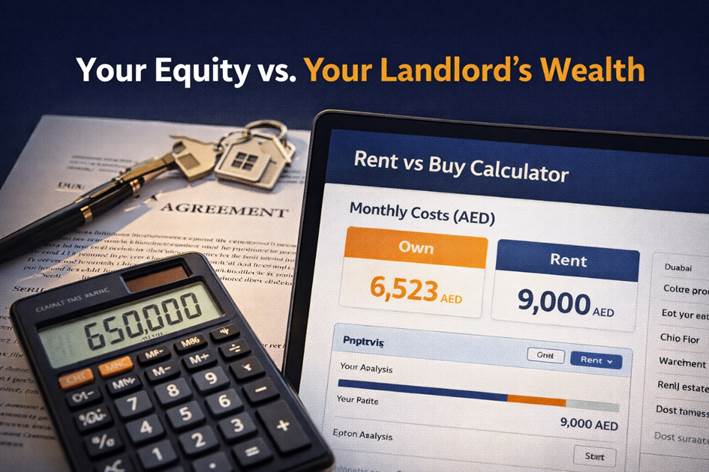

The Math of Homeownership: When using a mortgage vs. rent calculator, the gap between a monthly rent check and a bank installment is narrower than most realize. In fact, many residents find that paying off your own mortgage vs landlord’s is the most effective way to secure their financial future. When you look at the cost of owning a home vs renting, you must consider that rent is a 100% loss, whereas a mortgage is a transfer of wealth into your own pocket. Even when buying property in a high-interest rate environment, the concept of forced savings makes purchasing a superior long-term strategy.

Apartment Price Analysis (Title Deed)

As of December 2025, the average sales price for a Title Deed apartment in Dubai reached 1,672,949 AED. In contrast, the average Oqood (off-plan) transaction was slightly higher at 1,823,998 AED.

For a family looking at a 2 bedroom apartment inJVC (Jumeirah Village Circle), sales prices rose from 1,121 AED/sq. ft. in 2024 to 1,293 AED/sq. ft. in 2025. This trajectory indicates strong capital appreciation potential. Instead of paying off a landlord’s mortgage, owners are allocating their funds toward the interest portion vs principal of their own asset, building a future retirement planning in Dubai fund.

For instance, a rent vs buy calculator Dubai 2 bedroom apartment analysis in JVC shows that while rents are soaring, the average mortgage rate Dubai 2026 for expats remains competitive. This makes the down payment recovery period much shorter than in other global cities. In many cases, you might ask: how many years of rent equals buying a house in Dubai? Currently, the answer is often between 6 to 8 years, making it a clear win for long-term residents

The Break-Even Point

In the current Dubai property market trends 2026, the break-even point—the time it takes for the costs of buying to become lower than the costs of renting—is typically between 3 to 5 years. If you plan to stay in the city for this duration, buying is almost always “cheaper” due to wealth creation through real estate. Ultimately, the Rent vs Buy in Dubai decision for most expats comes down to how long they plan to call the city home.

3. Investor vs. End-User Benefits

Dubai caters to two distinct buyer profiles, each with unique goals.

For Investors: Rental Yield Analysis

Investors are primarily focused on return on investment (ROI) and buying property for rental income. To maximize passive income from Dubai real estate, one must identify the best areas for high rental yield in Dubai.

- International City: Yields remain strong as apartment sales prices average only 641 AED/sq. ft., while rents are rising at 7.94%.

- Town Square: A growing favorite for short-term vs. long-term rental yields, with a 15.79% rental hike in the last year.

For End-Users: Tangible Asset Security

End-users prioritize tangible asset security and avoiding hidden costs of buying vs. renting for families. While maintenance fees, transaction costs, and service charges impact the total cost of ownership, the benefit of owning a home—such as the ability to renovate or the security of not being evicted—often outweighs these expenses.

4. Rent vs Buy in Dubai: Is it Cheaper to Buy or Rent in Dubai Now?

The Villa Market: The demand for villas remains high as families seek space and privacy. However, the minimum salary to buy a villa in Dubai 2026 has risen alongside property valuation 2026.

Villa Sales Trends

The average sales price for a ready Title Deed villa in December 2025 reached 5,730,212 AED. Key community performance includes:

- Dubai Hills Estate: Sales prices rose from 2,286 AED/sq. ft. (2024) to 2,699 AED/sq. ft. (2025).

- The Meadows: Experienced a significant jump from 2,325 AED/sq. ft. to 3,081 AED/sq. ft..

- Al Barsha: While apartment rents stayed stable, villa sales prices saw a dramatic increase.

For families, the opportunity cost of not buying is the loss of the capital growth hotspots Dubai currently offers.

5. Strategic Considerations: Golden Visa and Taxation

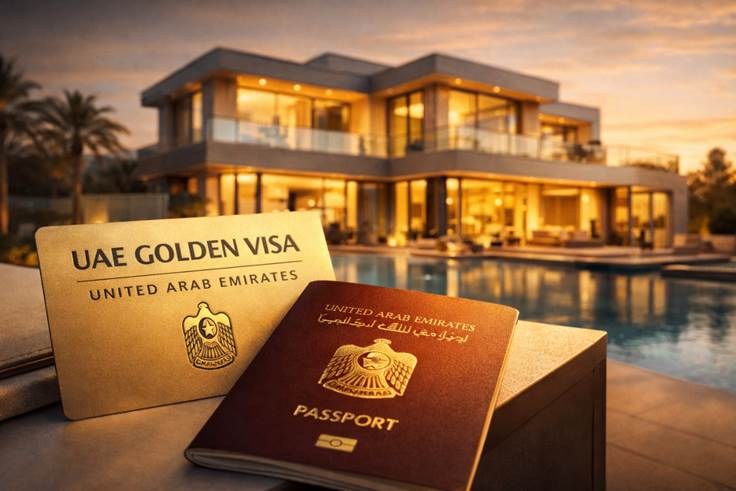

Golden Visa Property Investment

One of the strongest incentives for freehold property ownership is the Golden Visa. By investing in property worth 2 million AED or more, residents can secure long-term residency, making it a cornerstone for those pursuing retirement planning in Dubai.

Impact of Corporate Tax

As the city evolves, the impact of corporate tax on property investors Dubai must be monitored. While personal property ownership remains highly tax-efficient, professional portfolios and corporate holdings must account for these new regulations in their rental yield analysis.

6. Conclusion: The Path to Wealth Creation

Is 2026 a good time to buy property in Dubai? When evaluating the Rent vs Buy in Dubai landscape, the data suggests that as long as housing supply vs. demand remains tight and the RERA rental index updates continue to reflect high demand, buying remains the most effective property as an inflation hedge.

By shifting from a tenant mindset to an owner mindset, you transition from paying for a service to building an asset. Whether it is a studio for passive income or a luxury villa for family security, the Dubai real estate market offers a path to wealth creation that few other global cities can match.

Key Takeaways

- Rent vs. Buy: If staying for 3+ years, buying is financially superior due to equity accumulation.

- High Yields: Look toward International City or Town Square for the best ROI.

- Capital Growth: Dubai Hills and The Meadows lead the villa market in appreciation.

- Stability: Ownership eliminates eviction fears and rental hikes.

Make Your Move with Confidence

Navigating the 2026 Dubai property market requires more than just general trends—it requires a strategy tailored to your financial goals. Whether you are a family looking for long-term stability or an investor chasing high net rental income, we are here to bridge the gap between data and ownership.

Ready to see the math for your favorite community?

- Get a 5-Year Financial Projection: See how your equity grows compared to paying rent.

- Custom ROI Analysis: Discover the best areas for capital appreciation in 2026.

- Mortgage vs. Rent Assessment: Let us calculate your break-even point.

Contact Our Experts Today. Join hundreds of successful homeowners who trusted Veersant to turn their rental expenses into a tangible future.