The dream of “Buy-to-Let” in the United Kingdom is facing a historic identity crisis. For decades, a British terraced house was the gold standard for wealth creation. However, as we move through 2026, the data tells a different story. Smart capital is migrating. The question isn’t just about owning property; it’s about where your capital isn’t being eroded by taxes and stagnant growth. When comparing UK vs Dubai property investment 2026, the contrast in value, lifestyle, and “net” take-home pay has never been more stark.

1. Introduction: The UK Affordability Problem

To understand why investors are looking at the Middle East, we must look at the math behind the British market. According to long-term housing data, the UK housing market has reached a tipping point of “unaffordability.”

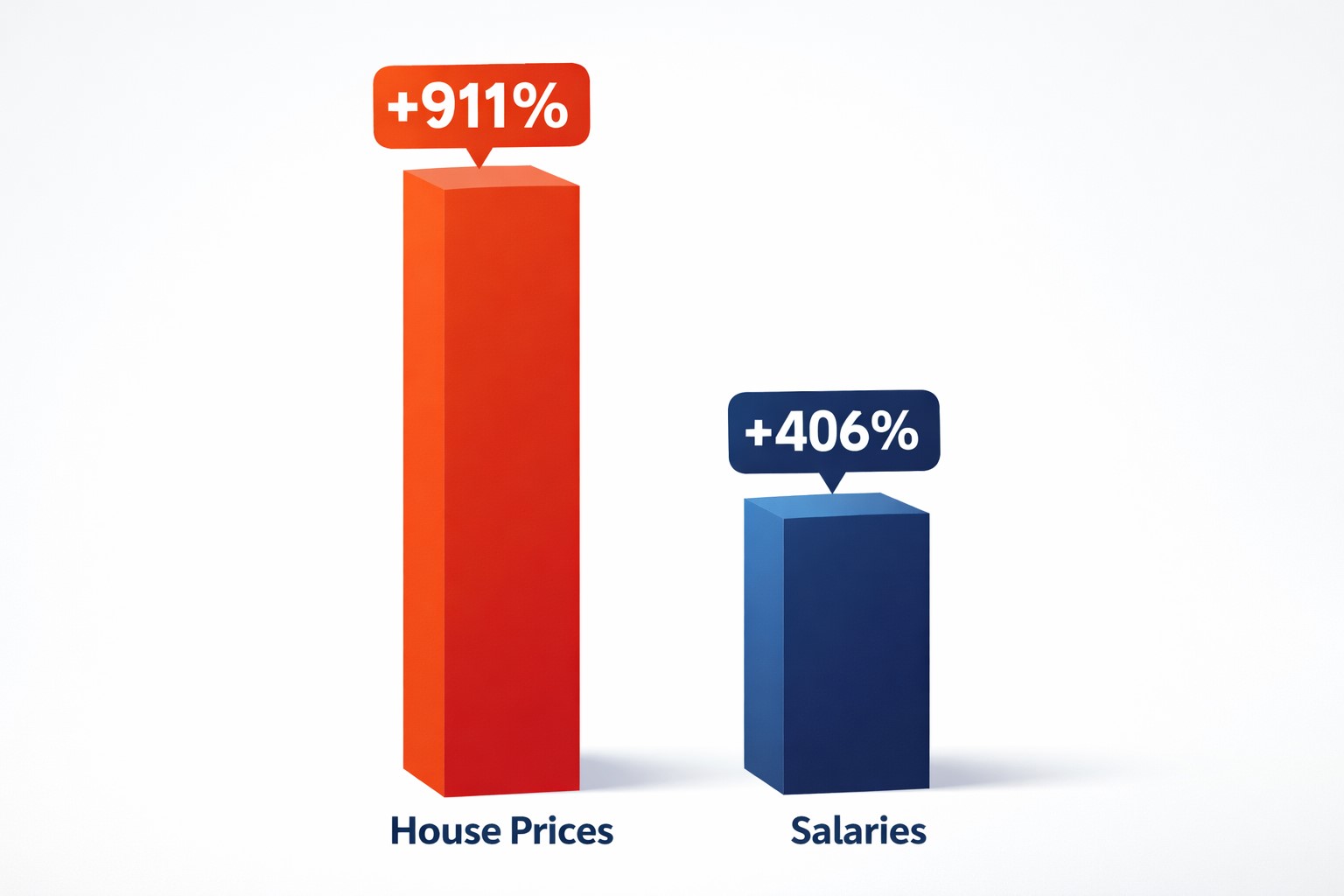

Since 1985, UK house prices have surged by a staggering 911%, while average salaries have only grown by 406%. This 505% “affordability gap” means that in 2026, the average home now costs 7.0x the annual salary, compared to just 3.5x four decades ago. With the UK housing market predictions 2026 suggesting continued price stickiness and high entry barriers, British investors are effectively being priced out of their own backyard.

2. UK Property Investment: The Real Numbers

Investing in a Manchester or Birmingham buy-to-let might offer a gross yield of 5%, but the “Real Numbers” are often sobering. Even with Birmingham Big Six regeneration investment projects, the high taxes often negate the gains

- Stamp Duty Land Tax (SDLT): Investors face a 3-5% surcharge on additional properties, reaching up to 15% for high-value assets.

- Taxation: The Renters Reform Bill and the removal of mortgage interest tax relief (Section 24) mean many landlords pay 40-45% income tax on turnover, not profit.

- Capital Gains Tax (CGT): Selling a UK investment property in 2026 triggers a 24% CGT on residential gains.

3. Dubai Property Investment: The Real Numbers

In contrast, the Dubai real estate market forecast 2026 remains bullish. When you invest £250,000 in Dubai, your money works harder because the “leaks” are plugged:

- Income Tax: 0%.

- Capital Gains Tax: 0%.

- Entry Cost: A one-time 4% DLD (Dubai Land Department) fee.

- Yields: While London struggles to hit 3-4% net, high-yield apartments in Dubai Marina or JVC consistently deliver 7-10% gross yields.

4. Why UK vs Dubai Property Investment 2026 is the Critical Turning Point

The year 2026 marks a shift in global wealth. While the UK grapples with UK Stamp Duty Land Tax 2026 adjustments and interest rate volatility, Dubai has matured into a regulated, transparent haven. Your money goes further because the Dubai property investment ROI 2026 is calculated on a “what you see is what you get” basis.

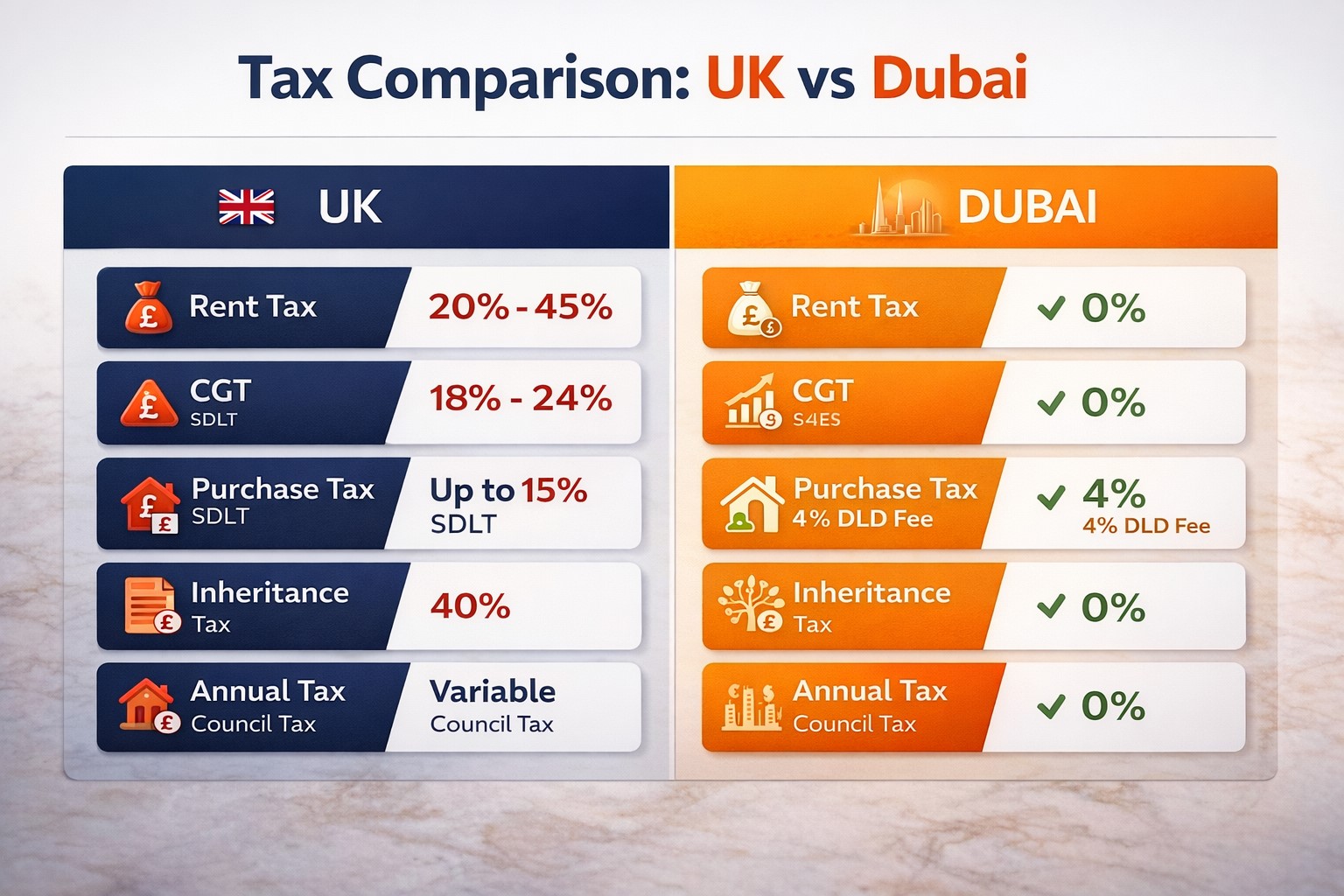

Tax Comparison Table: UK vs Dubai

| Tax/Fee Category | United Kingdom (UK) | Dubai (UAE) |

| Income Tax on Rent | 20% – 45% | 0% |

| Capital Gains Tax | 18% – 24% | 0% |

| Purchase Tax | SDLT (Up to 15%) | 4% DLD Fee |

| Inheritance Tax | 40% (above threshold) | 0% |

| Annual Property Tax | Council Tax (Variable) | 0% |

5. The Dubai Golden Visa Property 2026 Advantage

For UK residents, the investment isn’t just financial it’s existential. By investing AED 2M+ (approx. £430,000), investors qualify for the Dubai Golden Visa property 2026 program. This 10-year residency offers a hedge against UK economic instability, providing a “Plan B” that includes world-class healthcare, safety, and a tax-free lifestyle. For many, investing in Dubai property as a UK resident is now the fastest route to global mobility.

6. Dubai vs London Rental Yield Comparison

Let’s look at the specific Dubai vs London rental yield comparison for 2026:

- London (Zone 2/3): Average net yield after taxes and service charges: 2.1%.

- Dubai Marina / Business Bay: Average net yield: 6.4%.

- JVC (Jumeirah Village Circle): Emerging as a hotspot for best rental yields UK cities 2026 investors are envying, often hitting 8% net.

While Dubai Marina remains popular, the Dubai Creek Harbour investment potential is also drawing UK buyers looking for long-term growth.

7. What About the Risks? Is Dubai Property Safe?

A common question for British buyers is: “Is Dubai property safer than UK real estate?” In 2026, the answer is backed by Dubai Land Department investment trends. Strict RERA (Real Estate Regulatory Authority) regulations and mandatory Escrow accounts for off-plan property Dubai payment plans provide a robust safety net. With Dubai’s Escrow account laws and the oversight of RERA, your capital is protected under one of the world’s most transparent legal frameworks for off-plan and ready investments. The presence of IREM-certified firms like Veer & Sant further ensures that your investment is as secure as a London freehold, but with significantly higher upside.

8. Case Study: The London Pivot (Scenario 2026)

- Investor: Sarah, 38, London-based professional.

- Capital: £200,000.

- Option A (UK): A small 1-bed in a Northern Powerhouse property investment hub like Manchester. After SDLT, 5% mortgage rates, and 40% tax on rent, her monthly cash flow is £150.

- Option B (Dubai): A luxury studio in Business Bay. With 0% tax and high demand, her monthly cash flow is £1,400.

- The 5-Year Outlook: In Dubai, Sarah benefits from Dubai real estate capital appreciation 2026 trends, keeping 100% of her profit, whereas in the UK, nearly a quarter of her gain would vanish to the HMRC upon exit.

9. How to Buy Dubai Property From the UK

The process of diversifying property portfolio internationally has been streamlined:

- Selection: Choose between ready properties or off-plan property Dubai payment plans.

- Remote Transaction: Use digital DLD portals, no need to fly.

- Management: Partner with an agency like Veer & Sant to handle tenant sourcing and maintenance.

- Currency Hedge: Protect your wealth by moving GBP into AED (pegged to the USD).

10. Conclusion: Where Does Your Money Go Further?

The data is undeniable. With the UK housing market seeing a 911% price increase since 1985 without a proportional rise in yield or income, the “Buy-to-Let” model in Britain is working for the taxman, not the investor.

In the final analysis of UK vs Dubai property investment 2026, Dubai offers the superior ROI, a friendlier tax environment, and the added benefit of residency. Whether you are seeking high-yield apartments in Dubai Marina or luxury villas in Dubai Hills Estate, your capital travels significantly further in the UAE.

For HNWIs looking for the best real estate markets in 2026, Dubai remains the clear winner.

Ready to maximize your 2026 portfolio?

At Veer & Sant, we specialize in bridging the gap for UK investors. From Golden Visa consultancy to IREM-certified property management, we ensure your Dubai journey is seamless.

[Book a Free Consultation with our Dubai Experts] | [WhatsApp Us Now]