Is your rent money disappearing into a black hole, or is it building your future wealth?

For years, many residents in Dubai have viewed renting as the safe, flexible option. But as we move through late 2025, the financial landscape has shifted dramatically. With Dubai mortgage rates 2025 hitting historic lows and rental prices continuing their upward trajectory, a new reality has emerged: staying a tenant is becoming the more expensive choice. This guide explores why smart money is moving from tenancy to ownership and how you can capitalize on this window of mortgage affordability Dubai.

Data from October 2025 reveals a “perfect storm” for buyers: mortgage rates ranging from 3.89% to 4.99%, banks aggressively competing for business, and a regulatory framework that has never been more pro-investor. This isn’t just a market fluctuation; it is a mortgage revolution.

I. The Financial Foundation: How Dubai Mortgage Rates 2025 are Set

In the past, high interest rates kept many potential end-user property Dubai buyers on the sidelines. The key to securing the best Dubai Mortgage Rates 2025 lies in the stabilization and projected decline of the 3-month EIBOR rates (Emirates Interbank Offered Rate), the benchmark for most UAE loans.

Why Lower EIBOR is Transforming Affordability

The recent decline in the 3-month EIBOR rates directly impacts mortgage affordability and eligibility. Since most variable interest rate mortgages and initial fixed rates are benchmarked against EIBOR, a lower EIBOR means lower interest payable, which in turn improves the applicant’s Debt Burden Ratio (DBR) calculation. A lower interest payment means a larger portion of your income can be allocated toward the principal amount.

Rate Locking and Market Momentum

With rates at historic lows, the ability to secure fixed-rate mortgage locking (often for 3 to 5 years) provides a powerful hedge against future market volatility. This stability has fueled the market, with Dubai registered 9,300 residential mortgage transactions in Q1 2025 alone, representing a staggering 24% increase year-on-year.

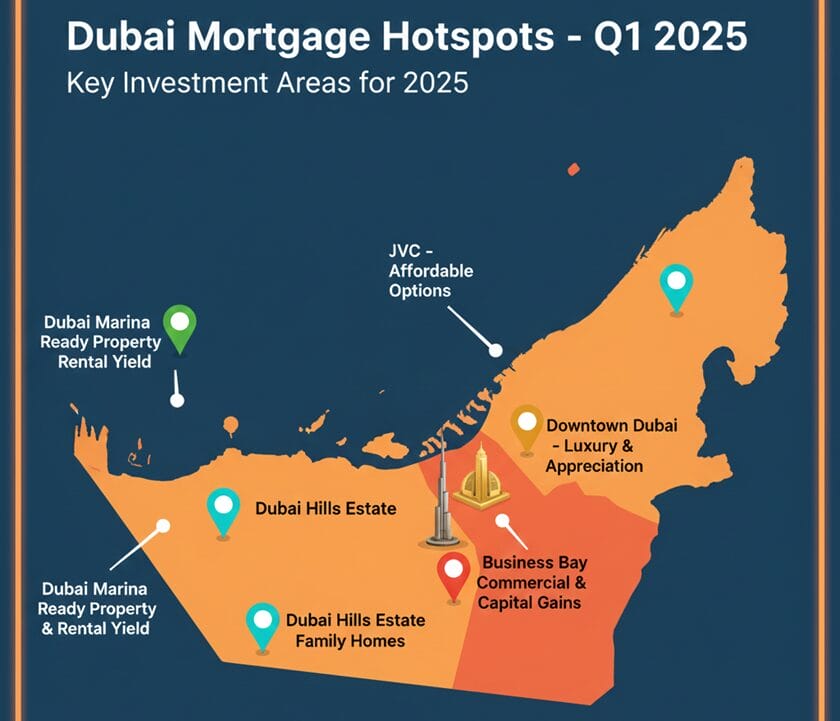

📊 Dubai Mortgage Activity by Key Area – Q1 2025 Analysis

| Area | Primary Audience | Q1 2025 Mortgage Volume (Est.) | Average Loan-to-Value (LTV) | Typical Rental Yield vs. Mortgage Costs |

| Dubai Marina | High-end/Expats | High | 65% | Mortgage Costs ≈ Rental Yield |

| Jumeirah Village Circle (JVC) | First-time Homebuyer Options | Very High | 80% | Mortgage Costs < Rental Yield |

| Business Bay | Young Professionals/Commercial | Medium | 70% | Higher Capital Gains Potential |

| Dubai Hills Estate | Family Homes | High | 75% | Strong Long-term asset appreciation |

| Downtown Dubai | Ultra-Luxury/Investors | Medium-High | 60% | Mortgage Costs > Rental Yield (Focus on Appreciation) |

II. The Rent VS Buy Calculator: Reaching the Break-Even Point Faster

Most people focus solely on the monthly payment, but the true financial genius of buying lies in Equity Buildup. When renting, 100% of your payment is an expense (“dead money”). With a mortgage, a significant portion builds your personal wealth.

The True Cost of Renting vs. Owning

The key calculation is the Break-even point: the moment when the total costs of buying (down payment, DLD fees, and cumulative mortgage payments) equal the total costs of renting the same property.

Numerical Example for the Break-Even Point:

Consider a mid-market property valued at AED 1.5 million. With current competitive rates (approx. 4.2% fixed), the monthly repayment (P&I) is significantly lower than when rates were higher. If the property’s current rental yield is AED 100,000 per year (AED 8,333 per month), and your mortgage payment is AED 6,500, the Break-even point (including DLD and agent fees) may now be reached in as little as 3-4 years. This rapid reduction in the required holding period is the most compelling marker of this buying window.

This favorable comparison of Rental yield vs. mortgage costs makes ownership the optimal choice for Long-term asset appreciation and Capital gains potential.

III. The Path to Ownership: Eligibility and Process

Many expats assume they cannot qualify, but UAE Central Bank regulations have evolved to encourage home ownership. The key is meeting the established criteria.

1. Loan Qualification

Banks will assess your Etihad Credit Bureau score and confirm that your Debt Burden Ratio (DBR) meets the legal requirement (typically 50% max). Securing Mortgage pre-approval early gives you an ironclad budget and leverage in negotiations.

2. Down Payment Threshold and LTV

Your starting equity position is defined by the Loan-to-Value ratio (LTV). For expats, this requires a minimum 20% Down payment threshold for properties under AED 5 million.

- Off-Plan Strategy: If the upfront cash requirement is challenging, look for generous Post-handover payment plans offered by developers. This form of Developer financing allows you to pay a substantial portion after taking possession, spreading the financial commitment over a longer term.

3. Fee Minimization

Take advantage of market competition. Many banks are currently offering a Processing fee waiver (often 1% of the loan amount). Additionally, developers may cover or subsidize the 4% Dubai Land Department (DLD) registration fee, significantly reducing the initial liquidity required.

IV. Geographic Hotspots: Maximizing ROI and Yields

While affordability is key, maximizing your investment depends heavily on location and your financial goal.

Residential Focus

- Downtown Dubai: Offers lower short-term rental yields but the highest Capital gains potential due to its global prestige and limited supply. It is a pure play on Long-term asset appreciation.

- Dubai Marina: Consistent demand for ready property and a balanced approach between appreciation and reliable rental income.

Commercial and Hybrid Focus

- Business Bay: An excellent dual-purpose area. With competitive Commercial mortgage rates now available, securing an office space here is a strategic move to stabilize business overheads. It offers exceptional Office space ROI potential and is a critical area for Business asset acquisition.

- Freezone vs Mainland property: Entrepreneurs must consider whether their business license allows them to purchase in the chosen jurisdiction.

V. Regulatory Security and The Golden Visa Bonus

For international investors, safety is paramount. Dubai’s regulatory environment provides multiple layers of protection.

Legal Certainty

- Escrow Account Protection: When purchasing off-plan, your payments are deposited into a regulated Escrow account protection monitored by the Real Estate Regulatory Agency (RERA). Funds are only released as construction milestones are verifiably met.

- Ownership Security: For off-plan purchases, the initial Oqood converts to a full Title Deed registration upon project completion, securing your Freehold property rights for life.

The Residency Advantage

- Golden Visa Eligibility: If your property (or portfolio) is valued at AED 2 million or more, you qualify for a 10-year Golden Visa. This applies even if the property is mortgaged, provided the down payment meets the requirements of the Taskeen Programme.

- Property Investor Visa: For properties valued at AED 750,000 or more, you can secure a 2-year renewable visa, utilizing Residency by investment.

Conclusion: Act Now

The convergence of low interest rates, the favorable shift in the Rental yield vs. mortgage costs, and the long-term stability offered by the Golden Visa creates a truly unique financial moment.

The time to transition From Renter to Owner is now, while Dubai Mortgage Rates 2025 are still catalyzing this economic shift. Stop funding your landlord’s portfolio and secure your own financial legacy.

Our team specializes in navigating the current landscape, from calculating your precise Amortization schedule to connecting you with banks offering the best first-time homebuyer options.

Contact us today for a free, confidential consultation and secure your future in Dubai